Investment Management

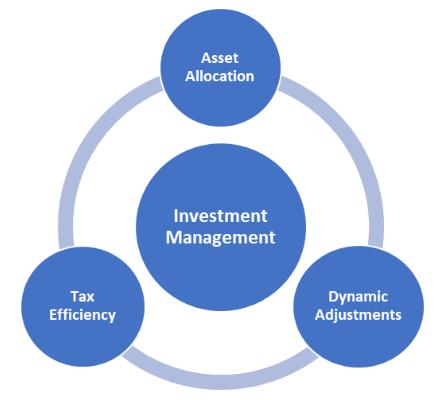

About the only certainty when it comes to the financial markets is that they will change. With this uncertainty, having a clearly defined investment management approach becomes key. While there will undoubtedly be difficult times, our role is to understand the risk/return tradeoff, along with the ever-changing investment landscape. That is why our approach is built in combination of three key principals.

Asset Allocation: Time horizon, age, and risk tolerance are a few variables that will determine what combination of investments are appropriate for you, or what we call “models”. Our team is committed to helping you find the right investment mix, so that it matches your defined objective(s).

Dynamic Adjustments: Markets are constantly changing, so it would make sense that the investments within a portfolio do as well. Our team has invested in resources that are integral to helping us understand this evolving landscape which allows us to make real-time adjustments within and across the various models.

Tax Efficiency: We understand there are many ways to make it to the finish line but not all these routes are created equal. Our team of experts is committed to minimizing the tax burden on you and your investments, both over the short and long-term.